Motivation

In order to predict the Bay area’s home prices, I chose the housing price dataset that was sourced from Bay Area Home Sales Database and Zillow. This dataset was based on the homes sold between January 2013 and December 2015. It has many characteristics of learning, and the dataset can be downloaded from here.

Data Preprocessing

import pandas as pd

sf = pd.read_csv('final_data.csv')

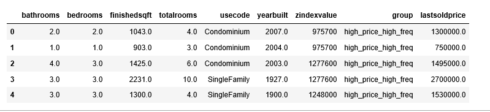

sf.head()

Copy

There are several features that we do not need, such as “info”, “z_address”, “zipcode”(We keep “neighborhood” as a location variable), “zipid” and “zestimate”(This is the price estimated by Zillow, we don’t want our model to be affected by this), so, we will drop them.

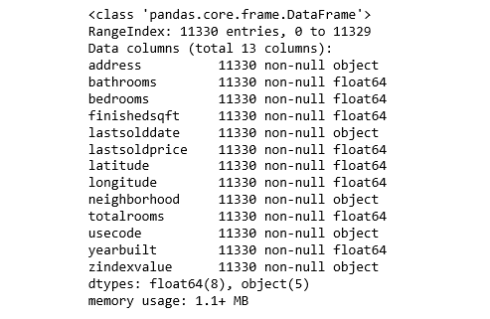

sf.drop(sf.columns[[0, 2, 3, 15, 17, 18]], axis=1, inplace=True) sf.info() Copy

The data type of “zindexvalue” should be numeric, so let’s change that.

sf['zindexvalue'] = sf['zindexvalue'].str.replace(',', '')

sf['zindexvalue'] = sf['zindexvalue'].convert_objects(convert_numeric=True)

sf.lastsolddate.min(), sf.lastsolddate.max()

('01/02/2013', '12/31/2015')

Copy

The house sold period in the dateset was between January 2013 and December 2015.

I now use the describe() method to show the summary statistics of the numeric variables.

sf.describe() Copy

The count, mean, min and max rows are self-explanatory. The std shows the standard deviation, and the 25%, 50% and 75% rows show the corresponding percentiles.

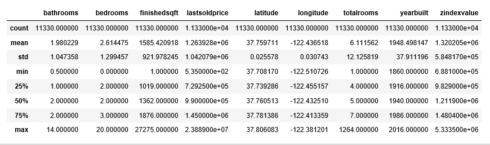

To get a feel for the type of data we are dealing with, we plot a histogram for each numeric variable.

%matplotlib inline

import matplotlib.pyplot as plt

sf.hist(bins=50, figsize=(20,15))

plt.savefig("attribute_histogram_plots")

plt.show()

Copy

Some of the histograms are a little bit right skewed, but this is not abnormal.

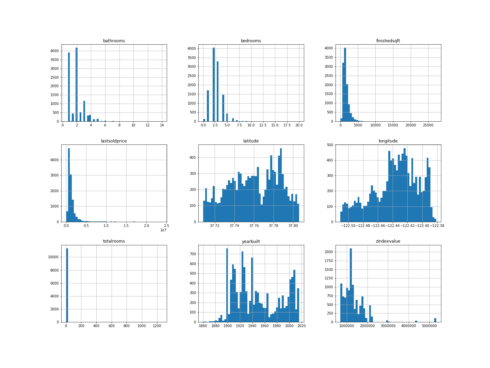

Let’s create a scatter plot with latitude and longitude to visualize the data:

sf.plot(kind="scatter", x="longitude", y="latitude", alpha=0.2)

plt.savefig('map1.png')

Copy

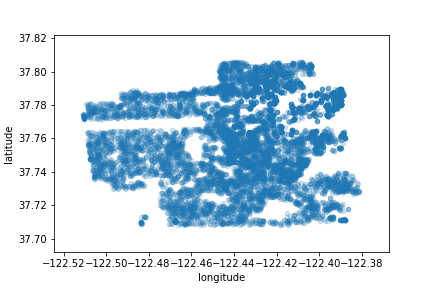

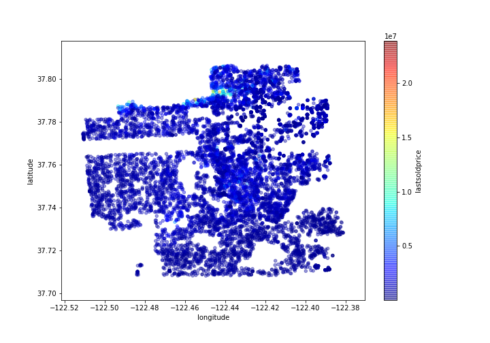

Now let’s color code from the most expensive to the least expensive areas:

sf.plot(kind="scatter", x="longitude", y="latitude", alpha=0.4, figsize=(10,7), c="lastsoldprice", cmap=plt.get_cmap("jet"), colorbar=True, sharex=False)

plt.savefig('map2.png')

Copy

This image tells us that the most expensive houses sold were in the north area.

The variable we are going to predict is the “last sold price”. So let’s look at how much each independent variable correlates with this dependent variable.

corr_matrix = sf.corr() corr_matrix["lastsoldprice"].sort_values(ascending=False) lastsoldprice 1.000000 finishedsqft 0.647208 bathrooms 0.536880 zindexvalue 0.460429 bedrooms 0.395478 latitude 0.283107 totalrooms 0.093527 longitude -0.052595 yearbuilt -0.189055 Name: lastsoldprice, dtype: float64 Copy

The last sold price tends to increase when the finished sqft and the number of bathrooms go up. You can see a small negative correlation between the year built and the last sold price. And finally, coefficients close to zero indicates that there is no linear correlation.

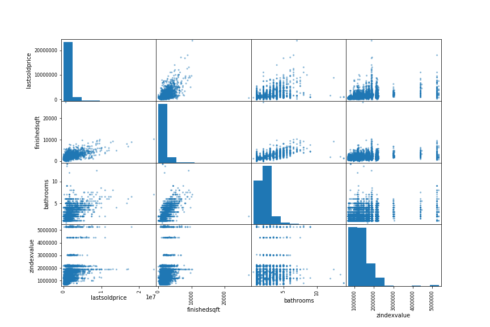

We are now going to visualize the correlation between variables by using Pandas’ scatter_matrix function. We will just focus on a few promising variables, that seem the most correlated with the last sold price.

from pandas.tools.plotting import scatter_matrix

attributes = ["lastsoldprice", "finishedsqft", "bathrooms", "zindexvalue"]

scatter_matrix(sf[attributes], figsize=(12, 8))

plt.savefig('matrix.png')

Copy

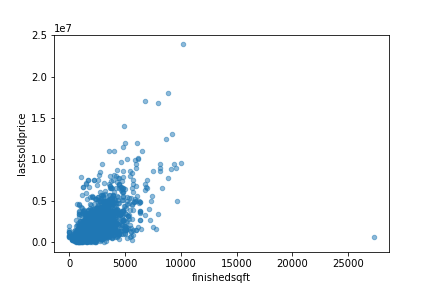

The most promising variable for predicting the last sold price is the finished sqft, so let’s zoom in on their correlation scatter plot.

sf.plot(kind="scatter", x="finishedsqft", y="lastsoldprice", alpha=0.5)

plt.savefig('scatter.png')

Copy

The correlation is indeed very strong; you can clearly see the upward trend and that the points are not too dispersed.

Because each house has different square footage and each neighborhood has different home prices, what we really need is the price per sqft. So, we add a new variable “price_per_sqft”. We then check to see how much this new independent variable correlates with the last sold price.

sf['price_per_sqft'] = sf['lastsoldprice']/sf['finishedsqft'] corr_matrix = sf.corr() corr_matrix["lastsoldprice"].sort_values(ascending=False) lastsoldprice 1.000000 finishedsqft 0.647208 bathrooms 0.536880 zindexvalue 0.460429 bedrooms 0.395478 latitude 0.283107 totalrooms 0.093527 price_per_sqft 0.005008 longitude -0.052595 yearbuilt -0.189055 Name: lastsoldprice, dtype: float64 Copy

Unfortunately, the new price_per_sqft variable shows only a very small positive correlation with the last sold price. But we still need this variable for grouping neighborhoods.

There are 71 neighborhoods in the data, and we are going to group them.

len(sf['neighborhood'].value_counts()) 71 Copy

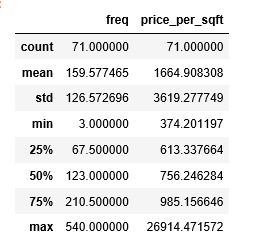

The following steps cluster the neighborhood into three groups: 1. low price; 2. high price low frequency; 3. high price high frequency.

freq = sf.groupby('neighborhood').count()['address']

mean = sf.groupby('neighborhood').mean()['price_per_sqft']

cluster = pd.concat([freq, mean], axis=1)

cluster['neighborhood'] = cluster.index

cluster.columns = ['freq', 'price_per_sqft','neighborhood']

cluster.describe()

Copy

These are the low price neighborhoods:

cluster1 = cluster[cluster.price_per_sqft < 756]

cluster1.index

Index(['Bayview', 'Central Richmond', 'Central Sunset', 'Crocker Amazon',

'Daly City', 'Diamond Heights', 'Excelsior', 'Forest Hill',

'Forest Hill Extension', 'Golden Gate Heights', 'Ingleside',

'Ingleside Heights', 'Ingleside Terrace', 'Inner Parkside',

'Inner Richmond', 'Inner Sunset', 'Lakeshore', 'Little Hollywood',

'Merced Heights', 'Mission Terrace', 'Mount Davidson Manor',

'Oceanview', 'Outer Mission', 'Outer Parkside', 'Outer Richmond',

'Outer Sunset', 'Parkside', 'Portola', 'Silver Terrace', 'Sunnyside',

'Visitacion Valley', 'West Portal', 'Western Addition',

'Westwood Highlands', 'Westwood Park'],

dtype='object', name='neighborhood')

Copy

These are the high price and low frequency neighborhoods:

cluster_temp = cluster[cluster.price_per_sqft >= 756]

cluster2 = cluster_temp[cluster_temp.freq <123]

cluster2.index

Index(['Buena Vista Park', 'Central Waterfront - Dogpatch', 'Corona Heights',

'Haight-Ashbury', 'Lakeside', 'Lone Mountain', 'Midtown Terrace',

'North Beach', 'North Waterfront', 'Parnassus - Ashbury',

'Presidio Heights', 'Sea Cliff', 'St. Francis Wood', 'Telegraph Hill',

'Twin Peaks'],

dtype='object', name='neighborhood')

Copy

These are the high price and high frequency neighborhoods:

cluster3 = cluster_temp[cluster_temp.freq >=123]

cluster3.index

Index(['Bernal Heights', 'Cow Hollow', 'Downtown',

'Eureka Valley - Dolores Heights - Castro', 'Glen Park', 'Hayes Valley',

'Lake', 'Lower Pacific Heights', 'Marina', 'Miraloma Park', 'Mission',

'Nob Hill', 'Noe Valley', 'North Panhandle', 'Pacific Heights',

'Potrero Hill', 'Russian Hill', 'South Beach', 'South of Market',

'Van Ness - Civic Center', 'Yerba Buena'],

dtype='object', name='neighborhood')

Copy

We add a group column based on the clusters:

def get_group(x):

if x in cluster1.index:

return 'low_price'

elif x in cluster2.index:

return 'high_price_low_freq'

else:

return 'high_price_high_freq'

sf['group'] = sf.neighborhood.apply(get_group)

Copy

After performing the above pre-processing, we do not need the following columns anymore: “address, lastsolddate, latitude, longitude, neighborhood, price_per_sqft”, so we drop them from our analysis.

sf.drop(sf.columns[[0, 4, 6, 7, 8, 13]], axis=1, inplace=True) sf = sf[['bathrooms', 'bedrooms', 'finishedsqft', 'totalrooms', 'usecode', 'yearbuilt','zindexvalue', 'group', 'lastsoldprice']] sf.head() Copy

Our data looks perfect!

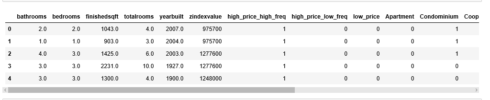

But before we build the model, we need to create dummy variables for these two categorical variables: “usecode” and “group”.

X = sf[['bathrooms', 'bedrooms', 'finishedsqft', 'totalrooms', 'usecode', 'yearbuilt', 'zindexvalue', 'group']] Y = sf['lastsoldprice'] n = pd.get_dummies(sf.group) X = pd.concat([X, n], axis=1) m = pd.get_dummies(sf.usecode) X = pd.concat([X, m], axis=1) drops = ['group', 'usecode'] X.drop(drops, inplace=True, axis=1) X.head() Copy

Train and Build a Linear Regression Model

from sklearn.cross_validation import train_test_split X_train, X_test, y_train, y_test = train_test_split(X, Y, test_size=0.3, random_state=0) from sklearn.linear_model import LinearRegression regressor = LinearRegression() regressor.fit(X_train, y_train) LinearRegression(copy_X=True, fit_intercept=True, n_jobs=1, normalize=False) Copy

Done! We now have a working Linear Regression model.

Calculate R squared:

y_pred = regressor.predict(X_test)

print('Liner Regression R squared: %.4f' % regressor.score(X_test, y_test))

Liner Regression R squared: 0.5619

Copy

So, in our model, 56.19% of the variability in Y can be explained using X. This is not that exciting.

Calculate root-mean-square error (RMSE):

import numpy as np

from sklearn.metrics import mean_squared_error

lin_mse = mean_squared_error(y_pred, y_test)

lin_rmse = np.sqrt(lin_mse)

print('Liner Regression RMSE: %.4f' % lin_rmse)

Liner Regression RMSE: 616071.5748

Copy

Our model was able to predict the value of every house in the test set within $616071 of the real price.

Calculate mean absolute error (MAE):

from sklearn.metrics import mean_absolute_error

lin_mae = mean_absolute_error(y_pred, y_test)

print('Liner Regression MAE: %.4f' % lin_mae)

Liner Regression MAE: 363742.1631

Copy

Random Forest

Let’s try a more complex model to see whether results can be improved — the RandomForestRegressor:

from sklearn.ensemble import RandomForestRegressor

forest_reg = RandomForestRegressor(random_state=42)

forest_reg.fit(X_train, y_train)

RandomForestRegressor(bootstrap=True, criterion='mse', max_depth=None,

max_features='auto', max_leaf_nodes=None,

min_impurity_split=1e-07, min_samples_leaf=1,

min_samples_split=2, min_weight_fraction_leaf=0.0,

n_estimators=10, n_jobs=1, oob_score=False, random_state=42,

verbose=0, warm_start=False)

Copy

print('Random Forest R squared": %.4f' % forest_reg.score(X_test, y_test))

Random Forest R squared": 0.6491

Copy

y_pred = forest_reg.predict(X_test)

forest_mse = mean_squared_error(y_pred, y_test)

forest_rmse = np.sqrt(forest_mse)

print('Random Forest RMSE: %.4f' % forest_rmse)

Random Forest RMSE: 551406.0926

Copy

Much better! Let’s try one more.

Gradient boosting

from sklearn import ensemble

from sklearn.ensemble import GradientBoostingRegressor

model = ensemble.GradientBoostingRegressor()

model.fit(X_train, y_train)

GradientBoostingRegressor(alpha=0.9, criterion='friedman_mse', init=None,

learning_rate=0.1, loss='ls', max_depth=3, max_features=None,

max_leaf_nodes=None, min_impurity_split=1e-07,

min_samples_leaf=1, min_samples_split=2,

min_weight_fraction_leaf=0.0, n_estimators=100,

presort='auto', random_state=None, subsample=1.0, verbose=0,

warm_start=False)

Copy

print('Gradient Boosting R squared": %.4f' % model.score(X_test, y_test))

Gradient Boosting R squared": 0.6616

Copy

y_pred = model.predict(X_test)

model_mse = mean_squared_error(y_pred, y_test)

model_rmse = np.sqrt(model_mse)

print('Gradient Boosting RMSE: %.4f' % model_rmse)

Gradient Boosting RMSE: 541503.7962

Copy

These are the best results we got so far, so, I would consider this is our final model.

Feature Importance

We have used 19 features (variables) in our model. Let’s find out which features are important and vice versa.

feature_labels = np.array(['bathrooms', 'bedrooms', 'finishedsqft', 'totalrooms', 'yearbuilt', 'zindexvalue',

'high_price_high_freq', 'high_price_low_freq', 'low_price', 'Apartment', 'Condominium', 'Cooperative',

'Duplex', 'Miscellaneous', 'Mobile', 'MultiFamily2To4', 'MultiFamily5Plus', 'SingleFamily',

'Townhouse'])

importance = model.feature_importances_

feature_indexes_by_importance = importance.argsort()

for index in feature_indexes_by_importance:

print('{}-{:.2f}%'.format(feature_labels[index], (importance[index] *100.0)))

Apartment-0.00%

MultiFamily5Plus-0.00%

Mobile-0.00%

Miscellaneous-0.00%

Cooperative-0.00%

Townhouse-0.00%

Condominium-0.54%

high_price_low_freq-0.69%

Duplex-1.21%

MultiFamily2To4-1.68%

high_price_high_freq-3.15%

bedrooms-3.17%

low_price-3.57%

SingleFamily-4.12%

yearbuilt-8.84%

totalrooms-9.13%

bathrooms-14.92%

zindexvalue-16.03%

finishedsqft-32.94%

Copy

The most important features are finished sqft, zindex value, number of bathrooms, total rooms, year built and so on. And the least important feature is Apartment, which means that regardless of whether this unit is an apartment or not, does not matter to the sold price. Overall, most of these 19 features are used.

Your Turn!

Hopefully, this post gives you a good idea of what a machine learning regression project looks like. As you can see, much of the work is in the data wrangling and the preparation steps, and these procedures consume most of the time spent on machine learning.

Now it’s time to get out there and start exploring and cleaning your data Try two or three algorithms, and let me know how it goes.