There are lots of applications of text classification in the commercial world. For example, news stories are typically organized by topics; content or products are often tagged by categories; users can be classified into cohorts based on how they talk about a product or brand online.

However, the vast majority of text classification articles and tutorials on the internet are binary text classification such as email spam filtering (spam vs. ham), sentiment analysis (positive vs. negative). In most cases, our real-world problem is much more complicated than that. Therefore, this is what we are going to do today: Classifying Consumer Finance Complaints into 12 pre-defined classes. The data can be downloaded from data.gov.

We use Python and Jupyter Notebook to develop our system, relying on Scikit-Learn for the machine learning components. If you would like to see an implementation in PySpark, read the next article.

Problem Formulation

The problem is supervised text classification problem, and our goal is to investigate which supervised machine learning methods are best suited to solve it.

Given a new complaint comes in, we want to assign it to one of 12 categories. The classifier makes the assumption that each new complaint is assigned to one and only one category. This is multi-class text classification problem. I can’t wait to see what we can achieve!

Data Exploration

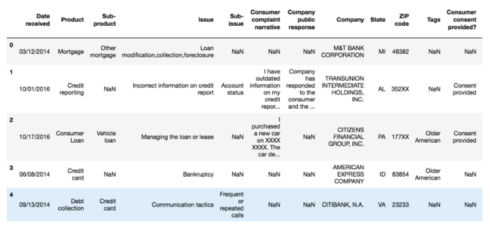

Before diving into training machine learning models, we should look at some examples first and the number of complaints in each class:

import pandas as pd

df = pd.read_csv('Consumer_Complaints.csv')

df.head()

For this project, we need only two columns — “Product” and “Consumer complaint narrative”.

- Input: Consumer_complaint_narrative

Example: “ I have outdated information on my credit report that I have previously disputed that has yet to be removed this information is more than seven years old and does not meet credit reporting requirements” - Output: product

Example: Credit reporting

We will remove missing values in “Consumer complaints narrative” column, and add a column encoding the product as an integer because categorical variables are often better represented by integers than strings.

We also create a couple of dictionaries for future use.

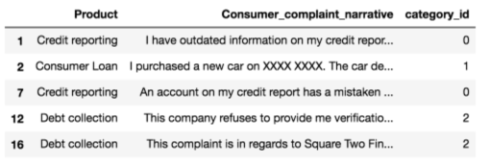

After cleaning up, this is the first five rows of the data we will be working on:

from io import StringIO

col = ['Product', 'Consumer complaint narrative']

df = df[col]

df = df[pd.notnull(df['Consumer complaint narrative'])]

df.columns = ['Product', 'Consumer_complaint_narrative']

df['category_id'] = df['Product'].factorize()[0]

category_id_df = df[['Product', 'category_id']].drop_duplicates().sort_values('category_id')

category_to_id = dict(category_id_df.values)

id_to_category = dict(category_id_df[['category_id', 'Product']].values)

df.head()

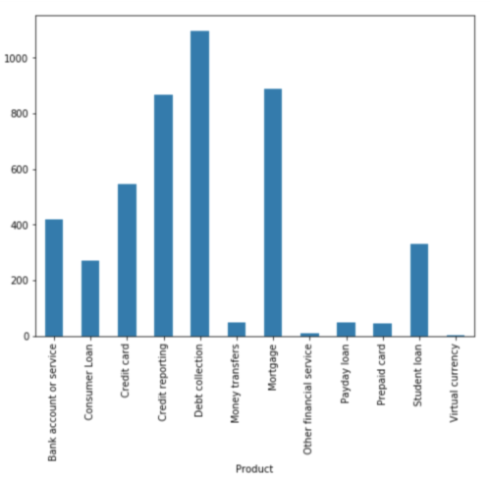

Imbalanced Classes

We see that the number of complaints per product is imbalanced. Consumers’ complaints are more biased towards Debt collection, Credit reporting and Mortgage.

import matplotlib.pyplot as plt

fig = plt.figure(figsize=(8,6))

df.groupby('Product').Consumer_complaint_narrative.count().plot.bar(ylim=0)

plt.show()

When we encounter such problems, we are bound to have difficulties solving them with standard algorithms. Conventional algorithms are often biased towards the majority class, not taking the data distribution into consideration. In the worst case, minority classes are treated as outliers and ignored. For some cases, such as fraud detection or cancer prediction, we would need to carefully configure our model or artificially balance the dataset, for example by undersampling or oversampling each class.

However, in our case of learning imbalanced data, the majority classes might be of our great interest. It is desirable to have a classifier that gives high prediction accuracy over the majority class, while maintaining reasonable accuracy for the minority classes. Therefore, we will leave it as it is.

Text Representation

The classifiers and learning algorithms can not directly process the text documents in their original form, as most of them expect numerical feature vectors with a fixed size rather than the raw text documents with variable length. Therefore, during the preprocessing step, the texts are converted to a more manageable representation.

One common approach for extracting features from the text is to use the bag of words model: a model where for each document, a complaint narrative in our case, the presence (and often the frequency) of words is taken into consideration, but the order in which they occur is ignored.

Specifically, for each term in our dataset, we will calculate a measure called Term Frequency, Inverse Document Frequency, abbreviated to tf-idf. We will use sklearn.feature_extraction.text.TfidfVectorizer to calculate a tf-idf vector for each of consumer complaint narratives:

- * sublinear_df is set to True to use a logarithmic form for frequency.

* min_df is the minimum numbers of documents a word must be present in to be kept.

* norm is set to l2, to ensure all our feature vectors have a euclidian norm of 1.

* ngram_range is set to (1, 2) to indicate that we want to consider both unigrams and bigrams.

* stop_words is set to “english” to remove all common pronouns (“a”, “the”, …) to reduce the number of noisy features.

from sklearn.feature_extraction.text import TfidfVectorizer tfidf = TfidfVectorizer(sublinear_tf=True, min_df=5, norm='l2', encoding='latin-1', ngram_range=(1, 2), stop_words='english') features = tfidf.fit_transform(df.Consumer_complaint_narrative).toarray() labels = df.category_id features.shape (4569, 12633)

Now, each of 4569 consumer complaint narratives is represented by 12633 features, representing the tf-idf score for different unigrams and bigrams.

We can use sklearn.feature_selection.chi2 to find the terms that are the most correlated with each of the products:

from sklearn.feature_selection import chi2

import numpy as np

N = 2

for Product, category_id in sorted(category_to_id.items()):

features_chi2 = chi2(features, labels == category_id)

indices = np.argsort(features_chi2[0])

feature_names = np.array(tfidf.get_feature_names())[indices]

unigrams = [v for v in feature_names if len(v.split(' ')) == 1]

bigrams = [v for v in feature_names if len(v.split(' ')) == 2]

print("# '{}':".format(Product))

print(" . Most correlated unigrams:\n. {}".format('\n. '.join(unigrams[-N:])))

print(" . Most correlated bigrams:\n. {}".format('\n. '.join(bigrams[-N:])))

# ‘Bank account or service’:

. Most correlated unigrams:

. bank

. overdraft

. Most correlated bigrams:

. overdraft fees

. checking account

# ‘Consumer Loan’:

. Most correlated unigrams:

. car

. vehicle

. Most correlated bigrams:

. vehicle xxxx

. toyota financial

# ‘Credit card’:

. Most correlated unigrams:

...

...

They all make sense, don’t you think so?

Multi-Class Classifier: Features and Design

* To train supervised classifiers, we first transformed the “Consumer complaint narrative” into a vector of numbers. We explored vector representations such as TF-IDF weighted vectors.

* After having this vector representations of the text we can train supervised classifiers to train unseen “Consumer complaint narrative” and predict the “product” on which they fall.

After all the above data transformation, now that we have all the features and labels, it is time to train the classifiers. There are a number of algorithms we can use for this type of problem.

Naive Bayes Classifier: the one most suitable for word counts is the multinomial variant:

from sklearn.model_selection import train_test_split from sklearn.feature_extraction.text import CountVectorizer from sklearn.feature_extraction.text import TfidfTransformer from sklearn.naive_bayes import MultinomialNB X_train, X_test, y_train, y_test = train_test_split(df['Consumer_complaint_narrative'], df['Product'], random_state = 0) count_vect = CountVectorizer() X_train_counts = count_vect.fit_transform(X_train) tfidf_transformer = TfidfTransformer() X_train_tfidf = tfidf_transformer.fit_transform(X_train_counts) clf = MultinomialNB().fit(X_train_tfidf, y_train)

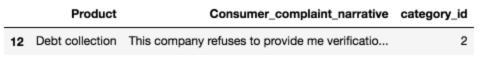

After fitting the training set, let’s make some predictions.

print(clf.predict(count_vect.transform(["This company refuses to provide me verification and validation of debt per my right under the FDCPA. I do not believe this debt is mine."]))) [‘Debt collection’]

df[df['Consumer_complaint_narrative'] == "This company refuses to provide me verification and validation of debt per my right under the FDCPA. I do not believe this debt is mine."]

print(clf.predict(count_vect.transform(["I am disputing the inaccurate information the Chex-Systems has on my credit report. I initially submitted a police report on XXXX/XXXX/16 and Chex Systems only deleted the items that I mentioned in the letter and not all the items that were actually listed on the police report. In other words they wanted me to say word for word to them what items were fraudulent. The total disregard of the police report and what accounts that it states that are fraudulent. If they just had paid a little closer attention to the police report I would not been in this position now and they would n't have to research once again. I would like the reported information to be removed : XXXX XXXX XXXX"]))) [‘Credit reporting’]

df[df['Consumer_complaint_narrative'] == "I am disputing the inaccurate information the Chex-Systems has on my credit report. I initially submitted a police report on XXXX/XXXX/16 and Chex Systems only deleted the items that I mentioned in the letter and not all the items that were actually listed on the police report. In other words they wanted me to say word for word to them what items were fraudulent. The total disregard of the police report and what accounts that it states that are fraudulent. If they just had paid a little closer attention to the police report I would not been in this position now and they would n't have to research once again. I would like the reported information to be removed : XXXX XXXX XXXX"]

Model Selection

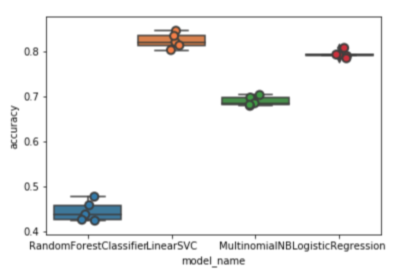

We are now ready to experiment with different machine learning models, evaluate their accuracy and find the source of any potential issues.

We will benchmark the following four models:

* Logistic Regression

* (Multinomial) Naive Bayes

* Linear Support Vector Machine

* Random Forest

from sklearn.linear_model import LogisticRegression

from sklearn.ensemble import RandomForestClassifier

from sklearn.svm import LinearSVC

from sklearn.model_selection import cross_val_score

models = [

RandomForestClassifier(n_estimators=200, max_depth=3, random_state=0),

LinearSVC(),

MultinomialNB(),

LogisticRegression(random_state=0),

]

CV = 5

cv_df = pd.DataFrame(index=range(CV * len(models)))

entries = []

for model in models:

model_name = model.__class__.__name__

accuracies = cross_val_score(model, features, labels, scoring='accuracy', cv=CV)

for fold_idx, accuracy in enumerate(accuracies):

entries.append((model_name, fold_idx, accuracy))

cv_df = pd.DataFrame(entries, columns=['model_name', 'fold_idx', 'accuracy'])

import seaborn as sns

sns.boxplot(x='model_name', y='accuracy', data=cv_df)

sns.stripplot(x='model_name', y='accuracy', data=cv_df,

size=8, jitter=True, edgecolor="gray", linewidth=2)

plt.show()

cv_df.groupby('model_name').accuracy.mean()

model_name

LinearSVC: 0.822890

LogisticRegression: 0.792927

MultinomialNB: 0.688519

RandomForestClassifier: 0.443826

Name: accuracy, dtype: float64

LinearSVC and Logistic Regression perform better than the other two classifiers, with LinearSVC having a slight advantage with a median accuracy of around 82%.

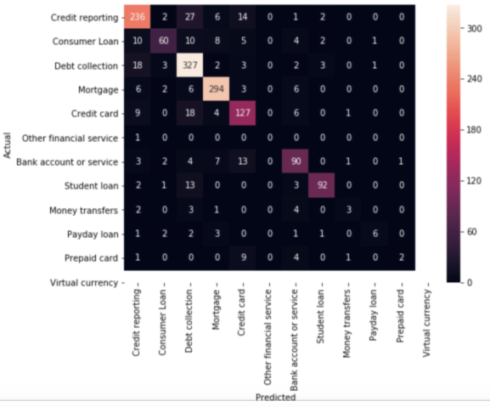

Model Evaluation

Continue with our best model (LinearSVC), we are going to look at the confusion matrix, and show the discrepancies between predicted and actual labels.

model = LinearSVC()

X_train, X_test, y_train, y_test, indices_train, indices_test = train_test_split(features, labels, df.index, test_size=0.33, random_state=0)

model.fit(X_train, y_train)

y_pred = model.predict(X_test)

from sklearn.metrics import confusion_matrix

conf_mat = confusion_matrix(y_test, y_pred)

fig, ax = plt.subplots(figsize=(10,10))

sns.heatmap(conf_mat, annot=True, fmt='d',

xticklabels=category_id_df.Product.values, yticklabels=category_id_df.Product.values)

plt.ylabel('Actual')

plt.xlabel('Predicted')

plt.show()

Gives this plot:

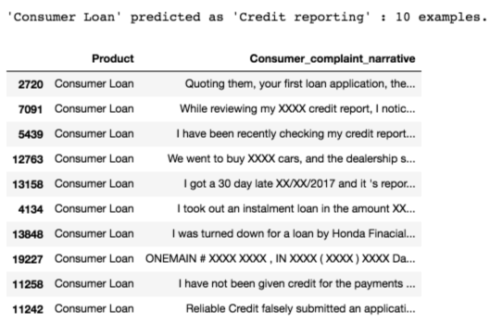

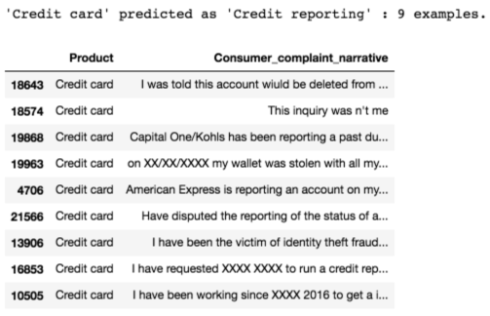

The vast majority of the predictions end up on the diagonal (predicted label = actual label), where we want them to be. However, there are a number of misclassifications, and it might be interesting to see what those are caused by:

from IPython.display import display

for predicted in category_id_df.category_id:

for actual in category_id_df.category_id:

if predicted != actual and conf_mat[actual, predicted] >= 10:

print("'{}' predicted as '{}' : {} examples.".format(id_to_category[actual], id_to_category[predicted], conf_mat[actual, predicted]))

display(df.loc[indices_test[(y_test == actual) & (y_pred == predicted)]][['Product', 'Consumer_complaint_narrative']])

print('')

As you can see, some of the misclassified complaints are complaints that touch on more than one subjects (for example, complaints involving both credit card and credit report). This sort of errors will always happen.

Again, we use the chi-squared test to find the terms that are the most correlated with each of the categories:

model.fit(features, labels)

N = 2

for Product, category_id in sorted(category_to_id.items()):

indices = np.argsort(model.coef_[category_id])

feature_names = np.array(tfidf.get_feature_names())[indices]

unigrams = [v for v in reversed(feature_names) if len(v.split(' ')) == 1][:N]

bigrams = [v for v in reversed(feature_names) if len(v.split(' ')) == 2][:N]

print("# '{}':".format(Product))

print(" . Top unigrams:\n . {}".format('\n . '.join(unigrams)))

print(" . Top bigrams:\n . {}".format('\n . '.join(bigrams)))

# ‘Bank account or service’:

. Top unigrams:

. bank

. account

. Top bigrams:

. debit card

. overdraft fees

# ‘Consumer Loan’:

. Top unigrams:

. vehicle

. car

. Top bigrams:

. personal loan

. history xxxx

# ‘Credit card’:

...

...

They are consistent within our expectations.

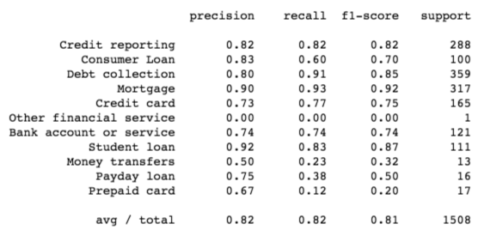

Finally, we print out the classification report for each class:

from sklearn import metrics print(metrics.classification_report(y_test, y_pred, target_names=df['Product'].unique()))

Source code can be found on Github.

I look forward to hearing any feedback or questions.