In time series analysis, structural changes represent shocks impacting the evolution with time of the data generating process. That is relevant because one of the key assumptions of the Box-Jenkins methodology is that the structure of the data generating process does not change over time. How can structural changes be identified ? The strucchange package can help in that and the present tutorial shows how.

R Packages

suppressPackageStartupMessages(library(strucchange)) suppressPackageStartupMessages(library(fUnitRoots)) suppressPackageStartupMessages(library(astsa)) Copy

Basic Data Exploration

We are going to do a basic exploration of the globtemp time series as available within the astsa package. The globtemp dataset reports the deviation (in degrees centigrade) from [1951-1980] global mean land-ocean temperature. Let us have a look at it.

data("globtemp")

globtemp

Time Series:

Start = 1880

End = 2015

Frequency = 1

[1] -0.20 -0.11 -0.10 -0.20 -0.28 -0.31 -0.30 -0.33 -0.20 -0.11 -0.37 -0.24 -0.27

[ t14] -0.30 -0.31 -0.22 -0.15 -0.11 -0.28 -0.16 -0.09 -0.15 -0.28 -0.36 -0.45 -0.28

[27] -0.23 -0.40 -0.44 -0.47 -0.43 -0.44 -0.35 -0.35 -0.16 -0.11 -0.33 -0.40 -0.26

[40] -0.23 -0.26 -0.21 -0.27 -0.24 -0.28 -0.20 -0.09 -0.20 -0.21 -0.36 -0.13 -0.09

[53] -0.17 -0.28 -0.13 -0.19 -0.15 -0.02 -0.02 -0.03 0.08 0.13 0.10 0.14 0.26

[66] 0.12 -0.03 -0.04 -0.09 -0.09 -0.17 -0.06 0.01 0.08 -0.12 -0.14 -0.20 0.03

[79] 0.06 0.03 -0.03 0.05 0.02 0.06 -0.20 -0.10 -0.05 -0.02 -0.07 0.07 0.03

[92] -0.09 0.01 0.15 -0.08 -0.01 -0.11 0.18 0.07 0.16 0.27 0.32 0.13 0.31

[105] 0.16 0.12 0.19 0.33 0.40 0.28 0.44 0.42 0.23 0.24 0.32 0.46 0.34

[118] 0.48 0.63 0.42 0.42 0.55 0.63 0.62 0.55 0.69 0.63 0.66 0.54 0.64

[131] 0.72 0.60 0.63 0.66 0.75 0.87

Copy

summary(globtemp)

Min. 1st Qu. Median Mean 3rd Qu. Max.

-0.47000 -0.21000 -0.07500 0.01838 0.18250 0.87000

Copy

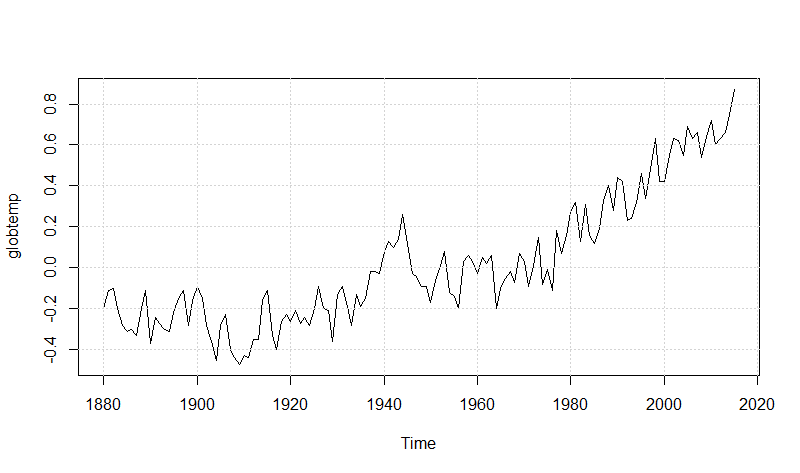

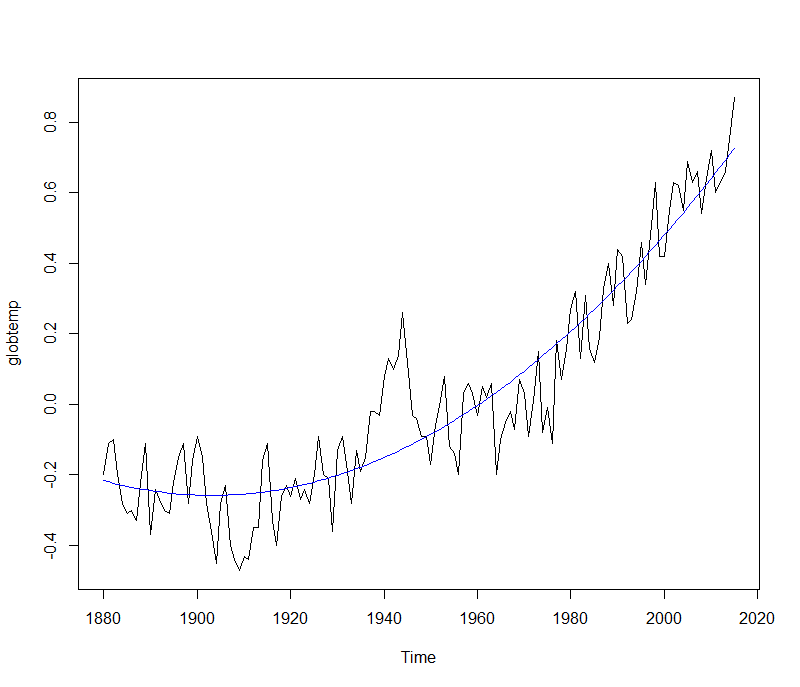

plot(globtemp) grid() Copy

We can see a remarkable increase of the temperature deviations in the last decades. The globtemp time series appears to be non stationary due basically to the last decades upward trend. A plot of globtemp against its smoothed fit may help in understand better.

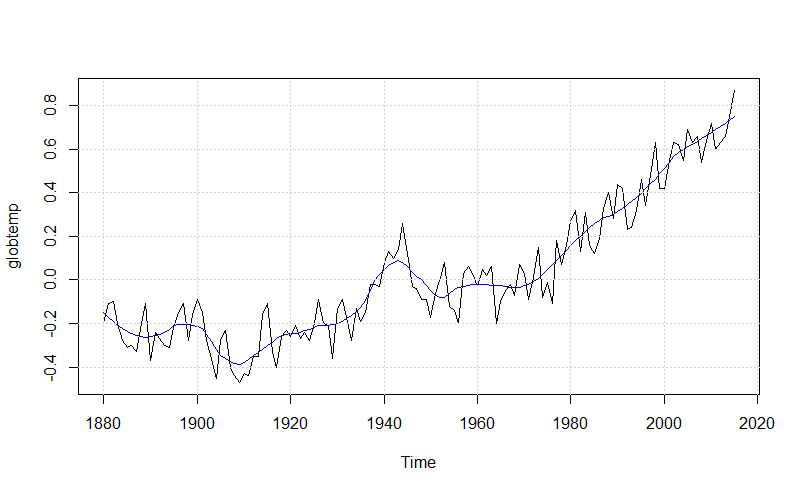

tt <- 1:length(globtemp) fit <- ts(loess(globtemp ~ tt, span = 0.2)$fitted, start = 1880, frequency = 1) plot(globtemp, type='l') lines(fit, col = 4) grid() Copy

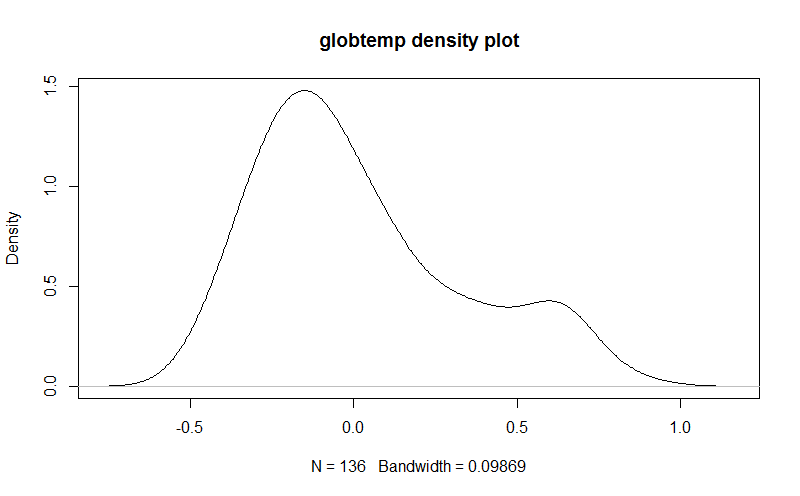

The globtemp density plot is herein shown.

plot(density(globtemp), main = "globtemp density plot") Copy

We are going to run the Augmented Dickey-Fuller test with type = “ct” having the following models, null-hypothesis and test statistics.

{ Model: Δyt = a0+γyt−1+a2t +ϵtH0:γ=0 test statistics:τ3H0:γ=a2=0 test statistics:ϕ3H0: a0=γ=a2=0 test statistics:ϕ2

See ref. [3] for details about the Dickey-Fuller test and its report as output by the urdfTest() function within the fUnitRoots package.

urdftest_lag = floor(12*(length(globtemp)/100)^0.25) # long

urdfTest(globtemp, lags = urdftest_lag, type = c("ct"), doplot = FALSE)

Title:

Augmented Dickey-Fuller Unit Root Test

Test Results:

Test regression trend

Call:

lm(formula = z.diff ~ z.lag.1 + 1 + tt + z.diff.lag)

Residuals:

Min 1Q Median 3Q Max

-0.233454 -0.061206 0.000907 0.067984 0.196946

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.066984 0.049114 -1.364 0.17546

z.lag.1 -0.104138 0.086354 -1.206 0.23048

tt 0.001213 0.000651 1.863 0.06517 .

z.diff.lag1 -0.273952 0.119332 -2.296 0.02362 *

z.diff.lag2 -0.324109 0.120821 -2.683 0.00845 **

z.diff.lag3 -0.263840 0.122262 -2.158 0.03314 *

z.diff.lag4 -0.029046 0.123184 -0.236 0.81404

z.diff.lag5 -0.164546 0.124910 -1.317 0.19052

z.diff.lag6 -0.121042 0.124239 -0.974 0.33210

z.diff.lag7 -0.063802 0.122548 -0.521 0.60369

z.diff.lag8 0.043304 0.119004 0.364 0.71665

z.diff.lag9 -0.088910 0.116985 -0.760 0.44891

z.diff.lag10 0.071604 0.111461 0.642 0.52197

z.diff.lag11 -0.049646 0.102584 -0.484 0.62940

z.diff.lag12 -0.037257 0.095916 -0.388 0.69846

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.09935 on 108 degrees of freedom

Multiple R-squared: 0.2657, Adjusted R-squared: 0.1705

F-statistic: 2.791 on 14 and 108 DF, p-value: 0.001403

Value of test-statistic is: -1.2059 2.8535 2.3462

Critical values for test statistics:

1pct 5pct 10pct

tau3 -3.99 -3.43 -3.13

phi2 6.22 4.75 4.07

phi3 8.43 6.49 5.47

Copy

By comparing the test statistics with the critical values at 5% significance level we cannot reject any of the null hypothesis. As a consequence, the unit root hypothesis cannot be rejected. Since in case of structural breaks, the Dickey Fuller test is biased toward the non rejection of the null hypothesis (ref. [3]), we run the KPSS test having the trend stationarity hypothesis as null (i.e. deterministic trend with stationary residuals).

urkpssTest(globtemp, type = c("tau"), lags = c("long"), doplot = FALSE)

Title:

KPSS Unit Root Test

Test Results:

Test is of type: tau with 12 lags.

Value of test-statistic is: 0.2114

Critical value for a significance level of:

10pct 5pct 2.5pct 1pct

critical values 0.119 0.146 0.176 0.216

Copy

We reject the trend stationarity hypothesis based on the resulting test statistics compared with their significance levels.

Structural Changes Detection

Bai and Perron established a general methodology for estimating breakpoints and their associated confidence intervals in OLS regression employing dynamic programming. In that way, it is possible to find m breakpoints that minimize the residual sum of square (RSS) associated to a model with m+1 segments given some minimal segment size of h·n observations. The h bandwidth parameter is chosen by the user typically equal to 0.1 or 0.15. Since the number of breakpoints m is not known in advance, it is necessary to compute the optimal breakpoints for m = 0, 1, … breaks and choose the model that minimizes some information criterion such as BIC (ref. [1]). That model selection strategy is available within breakpoints() function of the strucchange R package (ref. [2]).

Structural Changes Analysis

In the following, we determine the globtemp time series structural changes dates, if any. Such analysis is named as “dating structural changes (breaks)”. Specifically, we are looking for:

* level structural changes * trend structural changes * polinomial fit structural changes * auto-regressive model structural changes Copy

Level Structural Changes

Level structural changes can be determined with the help of the following formula:

globtemp ~ 1 Copy

We remark that any structural change analysis should be run against regressors which are significative in terms of time series fit. At that purpose we run:

summary(lm(globtemp ~ 1))

Call:

lm(formula = globtemp ~ 1)

Residuals:

Min 1Q Median 3Q Max

-0.48838 -0.22838 -0.09338 0.16412 0.85162

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.01838 0.02721 0.676 0.5

Residual standard error: 0.3173 on 135 degrees of freedom

Copy

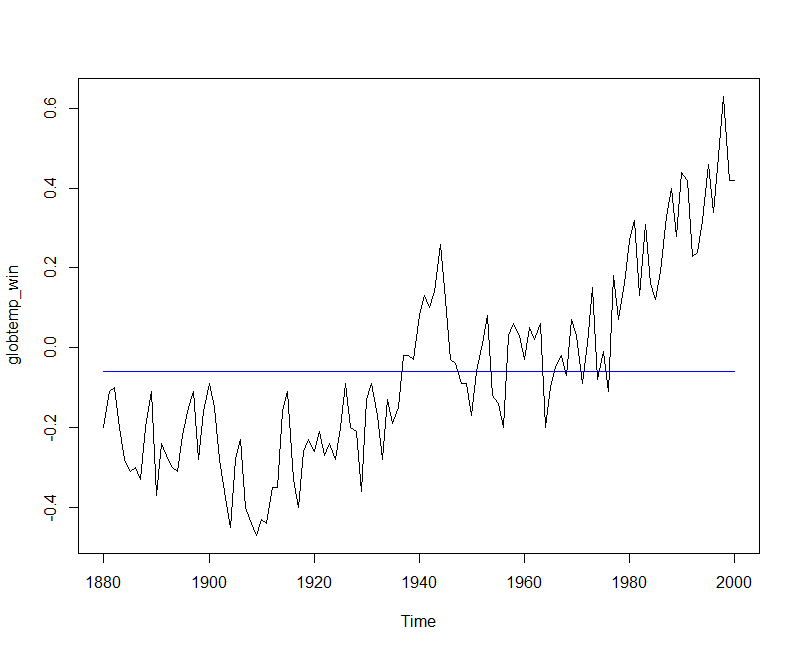

The intercept coefficient is not significative, likely due to the upward trend observable in the last decades. We then shorten our time series and run again the same regression.

globtemp_win <- window(globtemp, end = 2000)

lev_fit <- lm(globtemp_win ~ 1)

summary(lev_fit)

Call:

lm(formula = globtemp_win ~ 1)

Residuals:

Min 1Q Median 3Q Max

-0.41017 -0.17017 -0.04017 0.13983 0.68983

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.05983 0.02161 -2.769 0.00652 **

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.2377 on 120 degrees of freedom

Copy

The intercept coefficient is now reported as significant. Let us plot the time series against the fit.

plot(globtemp_win) lines(ts(fitted(lev_fit), start = 1880, frequency = 1), col = 4) Copy

We go on with the search for structural changes.

globtemp_brk <- breakpoints(globtemp_win ~ 1, h = 0.1)

summary(globtemp_brk)

Optimal (m+1)-segment partition:

Call:

breakpoints.formula(formula = globtemp_win ~ 1, h = 0.1)

Breakpoints at observation number:

m = 1 97

m = 2 57 100

m = 3 57 97 109

m = 4 22 34 57 100

m = 5 22 34 57 97 109

m = 6 22 34 57 69 97 109

m = 7 22 34 57 69 81 97 109

m = 8 22 34 46 58 70 85 97 109

m = 9 12 24 36 48 60 72 84 97 109

Corresponding to breakdates:

m = 1 1976

m = 2 1936 1979

m = 3 1936 1976 1988

m = 4 1901 1913 1936 1979

m = 5 1901 1913 1936 1976 1988

m = 6 1901 1913 1936 1948 1976 1988

m = 7 1901 1913 1936 1948 1960 1976 1988

m = 8 1901 1913 1925 1937 1949 1964 1976 1988

m = 9 1891 1903 1915 1927 1939 1951 1963 1976 1988

Fit:

m 0 1 2 3 4 5 6 7 8 9

RSS 6.7814 2.7965 1.3933 1.2582 1.1600 1.0249 0.9663 0.9606 0.9760 1.1440

BIC 4.3002 -93.2918 -168.0043 -170.7502 -170.9914 -176.3777 -173.9182 -165.0385 -153.5225 -124.7135

Copy

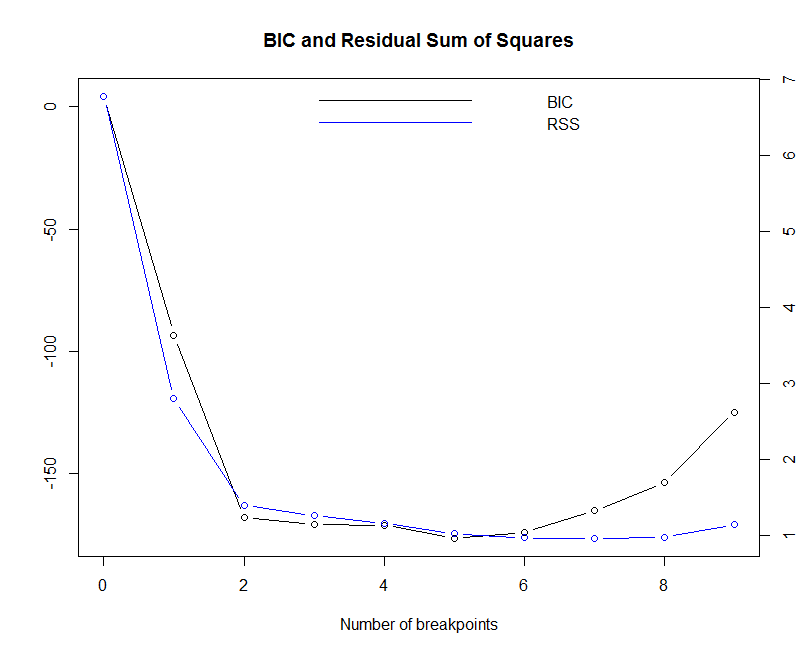

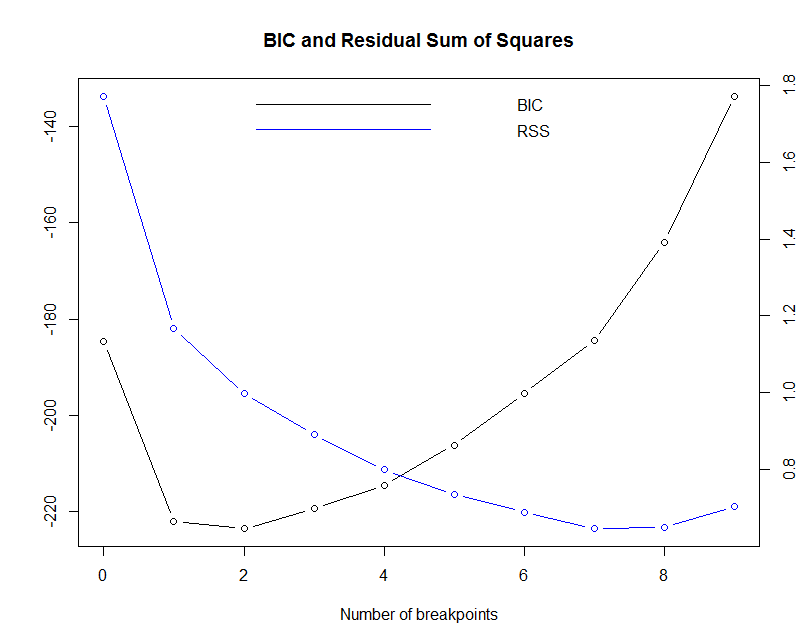

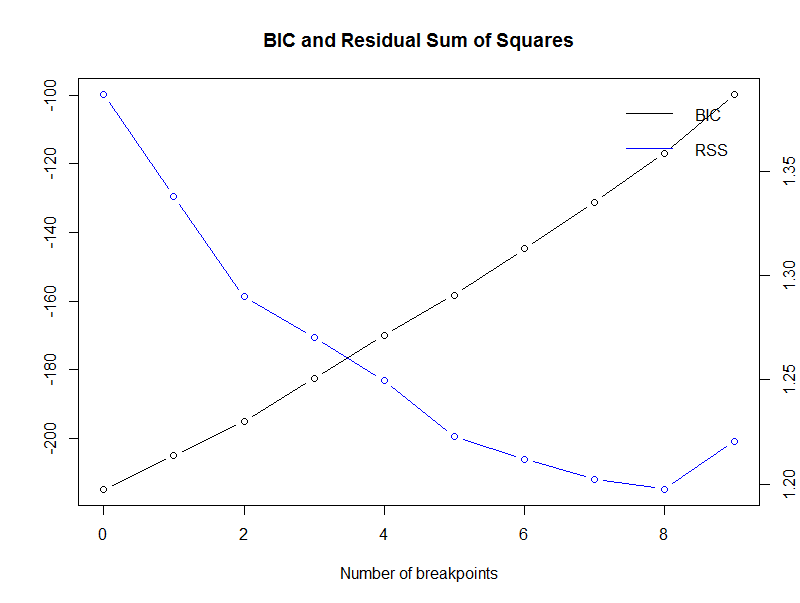

Above the results of finding m = 1..9 breakpoints with associated dates and {RSS, BIC} metrics. The minimum value of BIC is reached for m = 5. We plot the breakpoint() function output to gather a visual understanding of.

plot(globtemp_brk) Copy

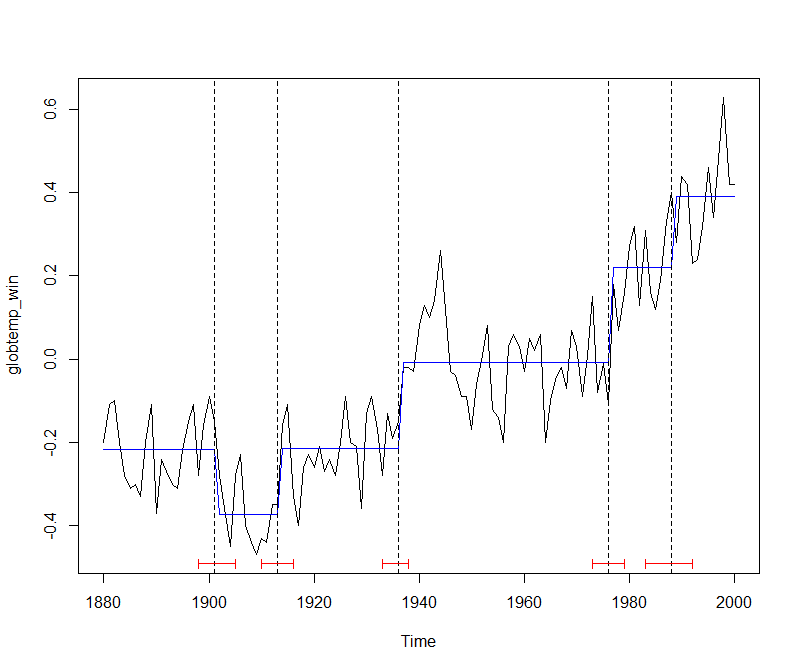

The plot of the observed and fitted time series, along with confidence intervals for the breakpoints, is given by:

plot(globtemp_win) lines(fitted(globtemp_brk, breaks = 5), col = 4) lines(confint(globtemp_brk, breaks = 5)) Copy

The break dates are:

breakdates(globtemp_brk, breaks = 5) [1] 1901 1913 1936 1976 1988 Copy

Level breaks coefficients:

coef(globtemp_brk, breaks = 5)

(Intercept)

1880 - 1901 -0.2177273

1902 - 1913 -0.3733333

1914 - 1936 -0.2152174

1937 - 1976 -0.0085000

1977 - 1988 0.2200000

1989 - 2000 0.3900000

Copy

Trend Structural Changes

Trend structural changes can be determined with the help of the following formula:

globtemp ~ tt Copy

where tt is the globtemp timeline (detailed below). Again, we have first to verify that such regression makes sense for our time series by evaluating coefficients significance.

l <- length(globtemp)

tt <- 1:l

trend_fit <- lm(globtemp ~ tt)

summary(trend_fit)

Call:

lm(formula = globtemp ~ tt)

Residuals:

Min 1Q Median 3Q Max

-0.33363 -0.11470 -0.02466 0.11932 0.38017

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.4600523 0.0273468 -16.82 <2e-16 ***

tt 0.0069844 0.0003464 20.16 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.1586 on 134 degrees of freedom

Multiple R-squared: 0.7521, Adjusted R-squared: 0.7503

F-statistic: 406.6 on 1 and 134 DF, p-value: < 2.2e-16

Copy

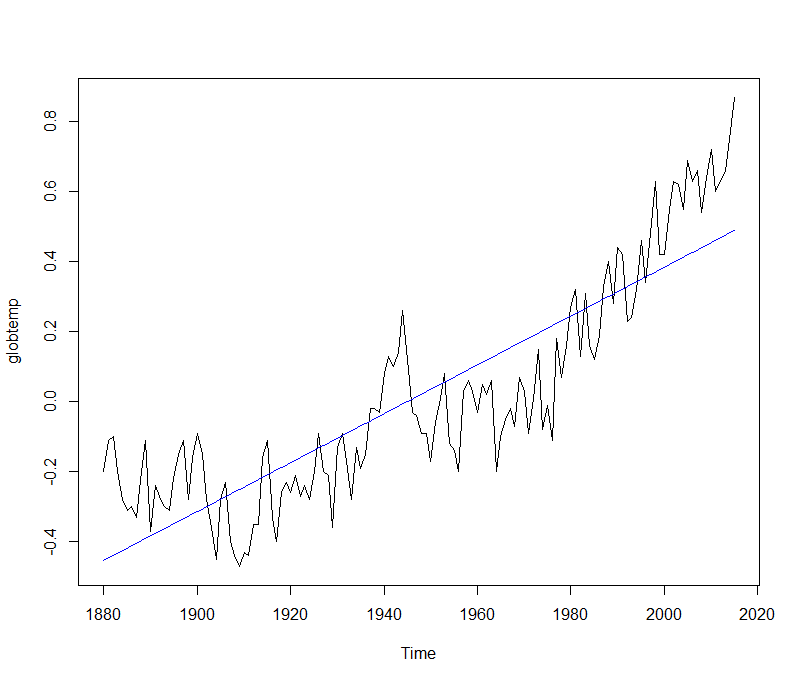

Both intercept and slope coefficients are reported as significative. Let us plot the time series against the fit.

plot(globtemp) lines(ts(fitted(trend_fit), start=1880, frequency = 1), col = 4) Copy

We go on with the search for structural changes.

globtemp_brk <- breakpoints(globtemp ~ tt, h = 0.1)

summary(globtemp_brk)

Optimal (m+1)-segment partition:

Call:

breakpoints.formula(formula = globtemp ~ tt, h = 0.1)

Breakpoints at observation number:

m = 1 84

m = 2 23 84

m = 3 27 66 84

m = 4 23 53 66 84

m = 5 16 32 53 66 84

m = 6 16 32 53 66 84 97

m = 7 16 32 53 66 84 97 117

m = 8 16 32 53 66 84 97 110 123

m = 9 14 27 40 53 66 84 97 110 123

Corresponding to breakdates:

m = 1 1963

m = 2 1902 1963

m = 3 1906 1945 1963

m = 4 1902 1932 1945 1963

m = 5 1895 1911 1932 1945 1963

m = 6 1895 1911 1932 1945 1963 1976

m = 7 1895 1911 1932 1945 1963 1976 1996

m = 8 1895 1911 1932 1945 1963 1976 1989 2002

m = 9 1893 1906 1919 1932 1945 1963 1976 1989 2002

Fit:

m 0 1 2 3 4 5 6 7 8 9

RSS 3.3697 1.6670 1.2446 1.0202 0.8907 0.8229 0.7975 0.7739 0.7889 0.8282

BIC -102.2140 -183.1946 -208.1954 -220.4943 -224.2281 -220.2494 -209.7707 -199.1243 -181.7788 -160.4341

Copy

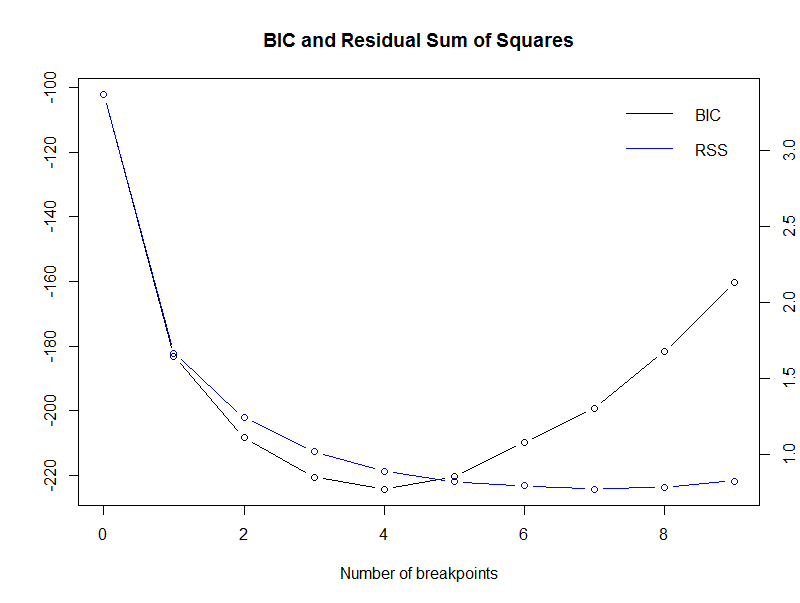

plot(globtemp_brk) Copy

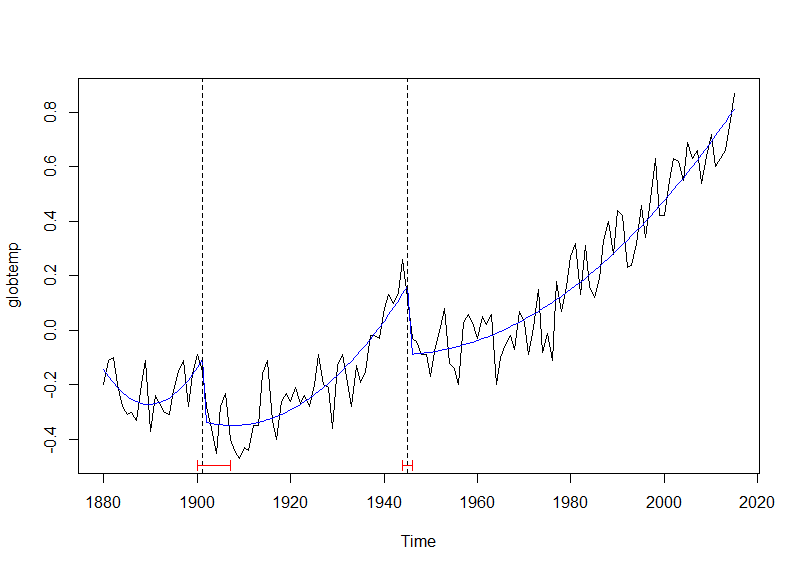

The BIC minimum value is reached for m = 4.

plot(globtemp) lines(fitted(globtemp_brk, breaks = 4), col = 4) lines(confint(globtemp_brk, breaks = 4)) Copy

Break dates:

breakdates(globtemp_brk, breaks = 4) [1] 1902 1932 1945 1963 Copy

Trend breaks coefficients:

coef(globtemp_brk, breaks = 4)

(Intercept) tt

1880 - 1902 -0.2312253 0.0008992095

1903 - 1932 -0.6037597 0.0084093437

1933 - 1945 -2.2475824 0.0374725275

1946 - 1963 -0.5640454 0.0070072239

1964 - 2015 -1.5983672 0.0173520874

Copy

Polinomial Fit Structural Changes

Second degree polinomial structural changes can be determined with the help of the following formula:

globtemp ~ tt + I(tt^2) Copy

where tt is the globtemp timeline. Once again, we have first to verify that such regression makes sense for our time series by evaluating coefficients significance.

pol_fit <- lm(globtemp ~ tt + I(tt^2))

summary(pol_fit)

Call:

lm(formula = globtemp ~ tt + I(tt^2))

Residuals:

Min 1Q Median 3Q Max

-0.27014 -0.08379 0.00685 0.07299 0.38625

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -2.124e-01 3.015e-02 -7.045 9.02e-11 ***

tt -3.784e-03 1.016e-03 -3.725 0.000288 ***

I(tt^2) 7.860e-05 7.183e-06 10.943 < 2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.1155 on 133 degrees of freedom

Multiple R-squared: 0.8696, Adjusted R-squared: 0.8676

F-statistic: 443.3 on 2 and 133 DF, p-value: < 2.2e-16

Copy

All coefficients are reported as significative. Let us plot the time series against the fit.

plot(globtemp, type = 'l') lines(ts(fitted(pol_fit), start = 1880, frequency = 1), col = 4) Copy

We go on with the search for structural changes.

globtemp_brk <- breakpoints(globtemp ~ tt + I(tt^2), data = globtemp, h = 0.1)

summary(globtemp_brk)

Optimal (m+1)-segment partition:

Call:

breakpoints.formula(formula = globtemp ~ tt + I(tt^2), h = 0.1,

data = globtemp)

Breakpoints at observation number:

m = 1 66

m = 2 22 66

m = 3 22 66 84

m = 4 20 36 66 84

m = 5 20 36 66 84 97

m = 6 20 36 53 66 84 97

m = 7 20 36 53 66 84 97 112

m = 8 20 36 53 66 84 97 110 123

m = 9 19 32 45 58 71 84 97 110 123

Corresponding to breakdates:

m = 1 1945

m = 2 1901 1945

m = 3 1901 1945 1963

m = 4 1899 1915 1945 1963

m = 5 1899 1915 1945 1963 1976

m = 6 1899 1915 1932 1945 1963 1976

m = 7 1899 1915 1932 1945 1963 1976 1991

m = 8 1899 1915 1932 1945 1963 1976 1989 2002

m = 9 1898 1911 1924 1937 1950 1963 1976 1989 2002

Fit:

m 0 1 2 3 4 5 6 7 8 9

RSS 1.7732 1.1662 0.9977 0.8903 0.7985 0.7348 0.6883 0.6453 0.6491 0.7024

BIC -184.6168 -221.9545 -223.5269 -219.3667 -214.5125 -206.1761 -195.4235 -184.5463 -164.0878 -133.7079

Copy

plot(globtemp_brk) Copy

The BIC minimum value is reached for m = 2.

plot(globtemp) lines(fitted(globtemp_brk, breaks = 2), col = 4) lines(confint(globtemp_brk, breaks = 2)) Copy

Break dates:

breakdates(globtemp_brk, breaks = 2) [1] 1901 1945 Copy

Polinomial fit breaks coefficients:

coef(globtemp_brk, breaks = 2)

(Intercept) tt I(tt^2)

1880 - 1901 -0.11675325 -0.02862084 0.0013226990

1902 - 1945 -0.06025445 -0.02034837 0.0003589594

1946 - 2015 0.61164924 -0.02197550 0.0001724349

Copy

Auto-regressive Model Structural Changes

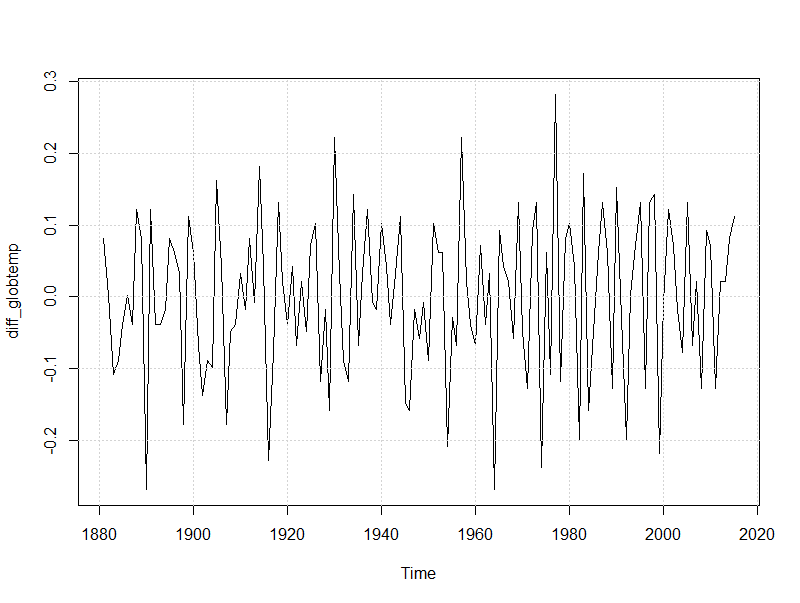

First differencing of the globtemp time series is computed to make it as stationary. The result is zero-centered by subtracting its mean.

diff_globtemp <- diff(globtemp) - mean(diff(globtemp)) plot(diff_globtemp, type = 'l') grid() Copy

The Augmented Dickey-Fuller test with type = “nc” having the following null hypothesis and test statistics is run.

{ Model: Δyt = γyt−1+ϵtH0:γ=0 test statistics:τ1

urdftest_lag = floor(12*(length(diff_globtemp)/100)^0.25) # long

urdfTest(diff_globtemp, lags = urdftest_lag, type = c("nc"), doplot = FALSE)

Title:

Augmented Dickey-Fuller Unit Root Test

Test Results:

Test regression none

Call:

lm(formula = z.diff ~ z.lag.1 - 1 + z.diff.lag)

Residuals:

Min 1Q Median 3Q Max

-0.21075 -0.06373 0.00499 0.07173 0.18976

Coefficients:

Estimate Std. Error t value Pr(>|t|)

z.lag.1 -2.69424 0.69716 -3.865 0.000189 ***

z.diff.lag1 1.35360 0.67167 2.015 0.046336 *

z.diff.lag2 0.98047 0.64080 1.530 0.128899

z.diff.lag3 0.69130 0.60389 1.145 0.254820

z.diff.lag4 0.64252 0.56115 1.145 0.254718

z.diff.lag5 0.47524 0.51691 0.919 0.359925

z.diff.lag6 0.34398 0.46422 0.741 0.460287

z.diff.lag7 0.26961 0.40719 0.662 0.509299

z.diff.lag8 0.29206 0.34707 0.842 0.401906

z.diff.lag9 0.20160 0.28928 0.697 0.487350

z.diff.lag10 0.25317 0.22206 1.140 0.256761

z.diff.lag11 0.17314 0.15559 1.113 0.268243

z.diff.lag12 0.10922 0.09352 1.168 0.245440

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.1003 on 109 degrees of freedom

Multiple R-squared: 0.6922, Adjusted R-squared: 0.6555

F-statistic: 18.86 on 13 and 109 DF, p-value: < 2.2e-16

Value of test-statistic is: -3.8646

Critical values for test statistics:

1pct 5pct 10pct

tau1 -2.58 -1.95 -1.62

Copy

By comparing the test statistics with the critical value at 5% significance level, we reject the unit root null-hypothesis. Further, we run the KPSS test with type = “mu” to test the null hypothesis of level stationarity.

urkpssTest(diff_globtemp, type = c("mu"), lags = c("long"), doplot = FALSE)

Title:

KPSS Unit Root Test

Test Results:

Test is of type: mu with 12 lags.

Value of test-statistic is: 0.3308

Critical value for a significance level of:

10pct 5pct 2.5pct 1pct

critical values 0.347 0.463 0.574 0.739

Copy

Based on the reported test statistics and critical values, we cannot reject the null hypothesis of level stationarity. We then evaluate a linear regression model having lag-1 and lag-2 as regressor to fit the current value.

lag_1 <- lag(diff_globtemp, -1)

lag_2 <- lag(diff_globtemp, -2)

globtemp_df <- ts.intersect(dd0 = diff_globtemp, dd1 = lag_1, dd2 = lag_2)

summary(lm(dd0 ~ dd1 + dd2 - 1, data = globtemp_df))

Call:

lm(formula = dd0 ~ dd1 + dd2 - 1, data = globtemp_df)

Residuals:

Min 1Q Median 3Q Max

-0.268417 -0.073502 0.007569 0.073164 0.266005

Coefficients:

Estimate Std. Error t value Pr(>|t|)

dd1 -0.30442 0.08463 -3.597 0.000455 ***

dd2 -0.27040 0.08463 -3.195 0.001752 **

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.1029 on 131 degrees of freedom

Multiple R-squared: 0.1246, Adjusted R-squared: 0.1112

F-statistic: 9.323 on 2 and 131 DF, p-value: 0.0001639

Copy

Both lag-1 and lag-2 coefficients are reported as significant. Then we inspect if any structural change occurs for our auto-regressive model.

dd_brk <- breakpoints(dd0 ~ dd1 + dd2 - 1, data = globtemp_df, h = 0.1)

summary(dd_brk)

Optimal (m+1)-segment partition:

Call:

breakpoints.formula(formula = dd0 ~ dd1 + dd2 - 1, h = 0.1, data = globtemp_df)

Breakpoints at observation number:

m = 1 78

m = 2 78 102

m = 3 64 78 102

m = 4 19 36 78 102

m = 5 17 35 63 78 102

m = 6 17 35 63 78 102 120

m = 7 17 35 48 64 78 102 120

m = 8 17 35 48 64 78 93 106 119

m = 9 13 26 39 54 67 80 93 106 119

Corresponding to breakdates:

m = 1 1960

m = 2 1960 1984

m = 3 1946 1960 1984

m = 4 1901 1918 1960 1984

m = 5 1899 1917 1945 1960 1984

m = 6 1899 1917 1945 1960 1984 2002

m = 7 1899 1917 1930 1946 1960 1984 2002

m = 8 1899 1917 1930 1946 1960 1975 1988 2001

m = 9 1895 1908 1921 1936 1949 1962 1975 1988 2001

Fit:

m 0 1 2 3 4 5 6 7 8 9

RSS 1.387 1.338 1.290 1.270 1.250 1.223 1.212 1.202 1.198 1.221

BIC -214.826 -204.918 -195.122 -182.486 -169.973 -158.211 -144.707 -131.090 -116.950 -99.757

Copy

plot(dd_brk) Copy

In this scenario, we cannot reach a conclusion for a value of m, as the BIC is minimum for m = 0. Ref. [1] shows a similar example and it points out that BIC was found to be somewhat unreliable for auto-regressive models by Bai and Perron. We then try to identify structural changes relying on a F statistics test available within the strucchange package as well.

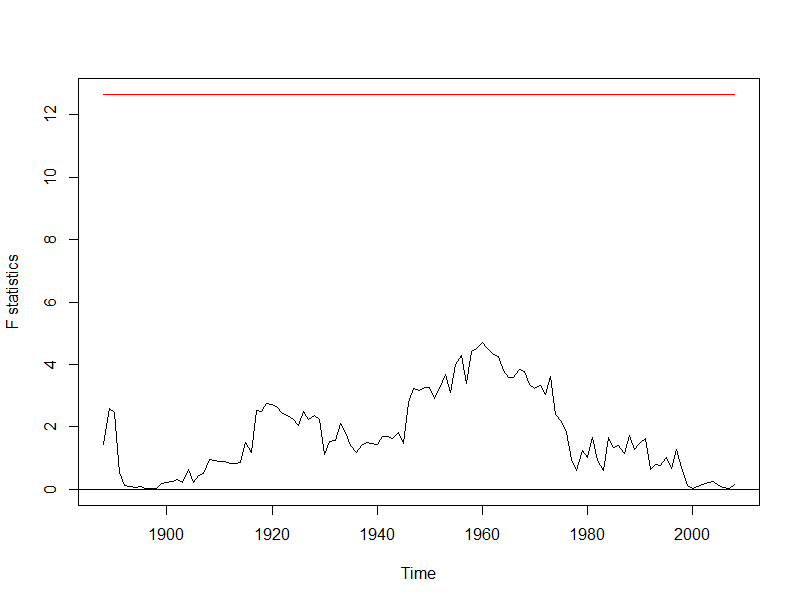

globtemp_Fstats <- Fstats(dd0 ~ dd1 + dd2 - 1, data = globtemp_df, from = 0.05, to = 0.95) plot(globtemp_Fstats) Copy

No boundary crossing can be spotted (the boundary is represented by the red horizontal line on the top of the plot).

sctest(globtemp_Fstats, type = "supF") supF test data: globtemp_Fstats sup.F = 4.7036, p-value = 0.7706 Copy

The sctest p-value confirms there is no significative breakpoint. We then conclude there are not any structural changes in the auto-regressive model under analysis.

Conclusions

After a basic exploration of the globtemp dataset, we leveraged on functions available within the strucchange package to date structural changes. Level, trend and second-degree polinomial fit breaks were identified. Differently, no breaks were found in the auto-regressive model based on lag-1 and lag-2 regressors. We further remark that the strucchange package provides with additional features such as generalized fluctuation tests as depicted by ref. [2].

If you have any questions, please feel free to comment below.

Disclaimer

- The present analysis is not intended to implement or to give basis for globtemp time series forecasts. It is intended for sake of introducing functionalities available within strucchange package.

References

-

[1] Applied Econometrics with R, Achim Zeileis, Christian Kleiber – Springer Ed.

[2] Strucchange package vignette

[3] Applied Econometrics Time Series, Walter Enders – Wiley Ed.

[4] GISS Surface Temperature Analysis (GISTEMP)